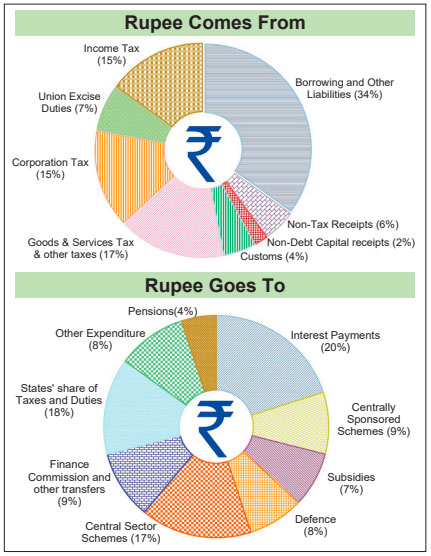

The Union Budget 2023- 24, presented by Finance Minister Nirmala Sitharaman in Parliament on February 1, seeks to build on the roadmap laid down by previous Budgets of the Modi Government. Coming in the pre-election year, the Budget stays away from populist announcements and remains focused on inclusive development, fostering growth and job-creation, while keeping the macroeconomy in a stable yet growthoriented mode. Some key features of the Budget 2023 and their potential impacts are summarised below:

The Union Budget 2023- 24, presented by Finance Minister Nirmala Sitharaman in Parliament on February 1, seeks to build on the roadmap laid down by previous Budgets of the Modi Government. Coming in the pre-election year, the Budget stays away from populist announcements and remains focused on inclusive development, fostering growth and job-creation, while keeping the macroeconomy in a stable yet growthoriented mode. Some key features of the Budget 2023 and their potential impacts are summarised below:

Infrastructure is key focus area

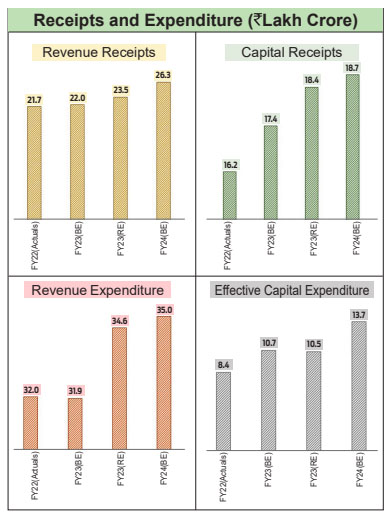

The continued focus on infrastructure development saw capital expenditure enhanced to an effective amount of INR 13.7 lakh crore which is 4.5 per cent of the GDP. Increased allocation to railways and a significant focus on seamless connectivity through road, rail, port, and airports will support multi-modal connectivity, while reducing the overall transportation and logistics costs.

This will also boost supply chain efficiencies on an overall basis. With additional focus on coastal shipping improvement, aiding both people and freight movement through Viability Gap Funding, and the development of 50 new airports, infrastructure will remain a key sector for focused growth.

The continuation of interest-free 50-year loans to state governments for an additional year, with an outlay of INR 1.3 lakh crore to support infrastructure development, will be a big boost to improving overall connectivity across the country. The announcement on tourism and related infrastructure focusing on its promotion through the PPP mode will support the overall economy and spur the demand for hotels and other related infrastructure creation.

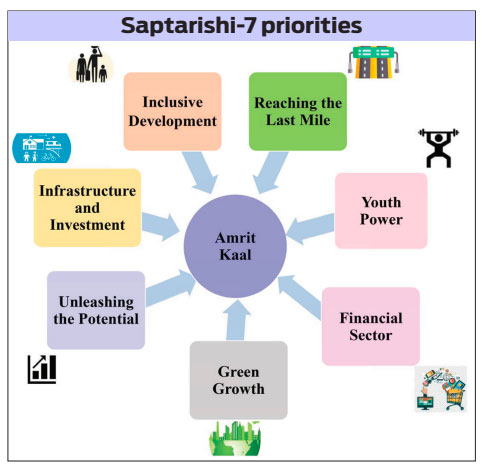

Net-zero journey gets galvanised

The aim towards net-zero carbon by 2070 has been galvanised with a grassroot-level focus in the current Budget. The enhanced production target of 5 mmt by 2030 for green hydrogen under the National Green Hydrogen Mission, the INR 35,000 crore outlay for priority capital investment in green power, green credit programme, PM Pranaam scheme for pushing alternative fertilizer usage, battery storage promotion through VGF as well as the vehicle scrapping policy will all support in the creation of a circular economy and put the country firmly on the path towards its sustainability targets.

The emphasis on green mobility and increasing ownership of EVs was supported by custom duty reduction on lithium-ion batteries and an extension of subsidy on EV batteries. Additionally, the Budget allocation for

FY 2024 under the FAME scheme has been enhanced from INR 2,908 cr to INR 5,172 cr. This will continue to provide a boost to EV production in the country.

Creating cities of tomorrow

Addressing the need for creating sustainable cities of tomorrow, the focus on urban planning, easing land availability, promoting TOD schemes and supporting urban local bodies in enhancing property tax collections will be key. The setting up of the Urban Infra Development Fund to be managed by the National Housing Bank, for urban infra improvement in tier 2 and 3 cities, is a welcome step towards creating more infra-led economic centres in the country.

Start-ups given fresh support

The Budget offered more support to the startup ecosystem by extending the date of incorporation for income tax benefits, for eligible start-ups, by one year till March 2024. Further, the benefit of carrying forward losses on change of shareholding has been increased from 7 years of incorporation to 10 years. This will provide policy support to help in sustaining the sector, boost investments while creating incentives for more startup founders. With the entrepreneurship environment moving towards a more positive light, job creation will also see elevation.

Affordable housing focus stays intact

From the real estate perspective, the Budget was not too exciting, barring the enhancing of the Pradhan Mantri Awas Yojana (PMAY) outlay by 66 per cent to Rs 79,000 crore. This will support the completion of the ‘Housing for All by 2025’ agenda and continue capital allocation for CLSS and other related schemes under PMAY.

Building pharma R&D capabilities

Pharma R&D was prioritised, which is likely to give a big boost to research and development activity in the pharmaceutical value-chain and create the need for such facilities in specialised zones across the country.

This will spur the development of lab spaces for such pharma firms, pushing more investment in the country and increasing the need for specialized real estate.

Salaried class gets income tax relief

The direct income tax benefits will bring more money into the hands of the middle and higher income class. This will support homebuying activity as it will ease the pressure of increased EMIs and higher home prices for prospective homebuyers.

The revision in Section 54 and 54F has now capped the deduction of capital gains from house property to INR 10 crore. This will create a higher tax incidence for high-value transactions.

Boost to digital transformation

The initiative of 100 labs for 5G applications will help develop usage for telecom networks beyond mobile phones. The rollout of 5G across the country and new applications developed by the Indian startup ecosystem is expected to spur exponential growth of data consumption and will translate to increased demand for data centres.

The setting up of Data Embassies in GIFT IFSC for countries seeking digital continuity solutions will facilitate the growth of data centres.

Many positives for job creation

On an overall basis, the focus on start-ups, MSMEs and manufacturing capacity building in the country are all positive from a job creation perspective, increased investment in the economy and the need for more real estate – both for offices and greenfield manufacturing facilities.

However, these benefits will accrue over a sustained period of time. The Budget is a balanced one for the economy. Tangible action points over the course of the next financial year would be awaited to see real on-ground activity on sustainable cities and net-zero targets.

G20 podium

G20 podium