THERE was a news report recently that a 95-year-old lady in Parlakhemundi, in Gajapati district of Odisha, had to be carried on a cycle rickshaw to her bank by her family members to collect her pension, which she was not getting for the last three months.

THERE was a news report recently that a 95-year-old lady in Parlakhemundi, in Gajapati district of Odisha, had to be carried on a cycle rickshaw to her bank by her family members to collect her pension, which she was not getting for the last three months.

However, having failed to avail of pension, family members approached the local municipality.

When the word reached Parlakhemundi Post Office, its staff was sent to her house; and it opened a zero-balance India Post Payment Bank account in her name.

The nonagenarian woman is now assured of pension at doorstep every month without any inconvenience to her, or to her family members.

IPPB anniversary

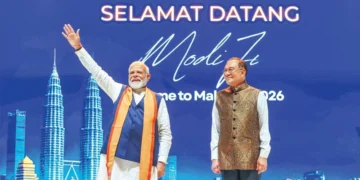

September 1 was the anniversary of India Post Payments Bank (IPPB), which was launched by Prime Minister Narendra Modi on this day in 2018.

It was introduced as an accessible, affordable, and trusted bank for the common man to leverage the vast network of the Department of Posts. The department covers all parts of the country with more than three lakh postmen and Grameen Dak Sewaks.

IPPB services are available across some 1.5 lakh post offices in the country, of which more than 1.2 lakh post offices are in rural areas. This is two-and-a-half times the number of bank branches in rural areas. Thus, IPPB significantly augments the reach of the banking sector in India.

The services include products such as savings and current accounts, money transfer, direct benefit transfers, bill and utility payments, and enterprise and merchant payments.

Multiple channels

These products and related services are offered across multiple channels– over-the-counter services, microATM, mobile banking app, SMS, and IVR – using modern technology platforms.

For a long time, it was felt that the post office network has vast potential through which Government services can be provided in every corner of the country.

India Post has been providing financial services through small savings schemes, money orders, and postal insurance for more than a hundred years through its vast network. But it was not part of the banking system and was not equipped to provide all banking services. That was made possible with the introduction of the IPPB.

The idea for such service gained momentum in 2013 when the Reserve Bank of India brought out a paper on policy discussion on the topic ‘Banking Structure in India – The Way Forward’.

Differentiated bank

In this discussion, a suggestion was made about the need for creation of differentiated banks in India. It was further stated that in this direction, financing of infrastructure facilities, licensing for wholesale banking and retail banking might be a desirable step.

Subsequently, the Committee on Comprehensive Financial Services for Small Businesses and LowIncome Families released its report in January 2014 from which the idea of issuing licences for Payments Bank by RBI emerged.

The then Finance Minister Arun Jaitley, while presenting Union Budget 2014-15 on July 10, 2014, mentioned that RBI will create a framework for licensing small banks and other differentiated banks.

Differentiated banks serving niche interests, local area banks, payment banks etc. are contemplated to meet credit and remittance needs of small businesses, unorganised sector, low-income households, farmers and migrant workforce, he had stated.

Based on this policy direction, RBI) issued Guidelines for Licensing of Payment Banks on November 27, 2014. The Department of Posts applied for a payments bank license on January 30, 2015. Seven months later, it was granted an inprinciple licence to set up India Post Payments Bank.

The IPPB was launched as a pilot project on January 30, 2017, in Ranchi (Jharkhand) and Raipur (Chhattisgarh). In August 2018, the Union Cabinet approved Rs 1,435 crore as cost for setting up the bank.